Taking no prisoners: the rise in captive insurance

In the last few years, businesses have had a lot to deal with – a pandemic, spate of natural disasters, runaway inflation, disrupted supply chains, war, increasingly evident impacts of climate change and a weak economic outlook. These factors have also impacted the insurance industry and, as a consequence, the commercial insurance market has experienced hard market conditions. As a result, businesses have faced greater challenges in insuring risks due to a lack of capacity, and higher premiums and more stringent terms and conditions when they can secure cover.

With the global commercial insurance market the hardest it has been in two decades, and with premiums expected to continue rising, more businesses are looking at ways to manage their total cost of risk. Increasingly, large companies are turning their attention to self-insurance and alternative risk transfer solutions to reduce the cost of risk and to fill any gaps in their coverage. Such solutions are becoming integral components of their risk management and insurance strategies.

Among the solutions gaining prominence, is the use of captives.

What is captive insurance?

Captives are a form of self-insurance where the company sets up its own in-house insurer or reinsurer and manages a portion of its own risk.

Essentially, the insurer is owned by the insured (parent company), instead of obtaining insurance from a third-party insurance company.

The captive insurer is controlled by the parent company and is usually established to provide coverage for risks that are difficult or expensive to insure through traditional insurance channels.

By forming its own wholly-owned, licensed insurance or reinsurance company to protect against its unique business risks, a company can manage difficult-to-insure risks, plug gaps in its risk cover, and keep a lid on rising insurance costs. It can also capture profitable premium that would otherwise be paid to commercial insurers.

How established are captives?

The concept isn’t new. According to Swiss Re, captives have been around since the 1950s but rose to prominence in the 1980s when they were often used as tax-efficiency vehicles. Since then, regulatory crackdowns have seen them return to their risk management roots.

The captive insurance market is estimated to be worth US$100 billion. The reinsurance giant notes there are more captive insurance companies than traditional insurers globally – estimated at more than 7,000 captives domiciled in more than 70 jurisdictions.

How do captives work?

In a captive insurance arrangement, the insured (parent company) brings some of its risk in-house by creating a licensed company that provides insurance to its parent company and/or affiliates.

Once established, the captive works in the same way as a commercial insurance company and is subject to statutory regulatory requirements including reporting, capital and reserve requirements. Similar to traditional insurance programs, the captive underwrites risks, issues policies, and processes and pays internal claims. The key difference is that a captive gives its parent company the option to retain or distribute profits across the business, whereas a traditional insurance company retains those profits.

What are the captive options?

There are numerous types of captives, each designed to meet the specific needs of the parent business.

The most common form is a single parent captive, in which a parent company creates its own captive to insure its own risks. Group captives see a group of businesses come together to create a captive insurance company to insure their collective risks.

Another example is the protected cell captive. This is where a captive insurance company is divided into individual cells, each of which operates as a separate legal entity with its own assets and liabilities.

What type of companies use captives?

Captives are primarily used by larger businesses with significant risk exposures and challenges in accessing optimal insurance solutions from the traditional insurance market. The business also needs to have the financial resources to support an insurance subsidiary as a dedicated business.

Once the domain of large corporates, the emergence of new and more innovative products (such as virtual captives and protected cell captives) has opened up the solution to mid-sized businesses looking to self-insure.

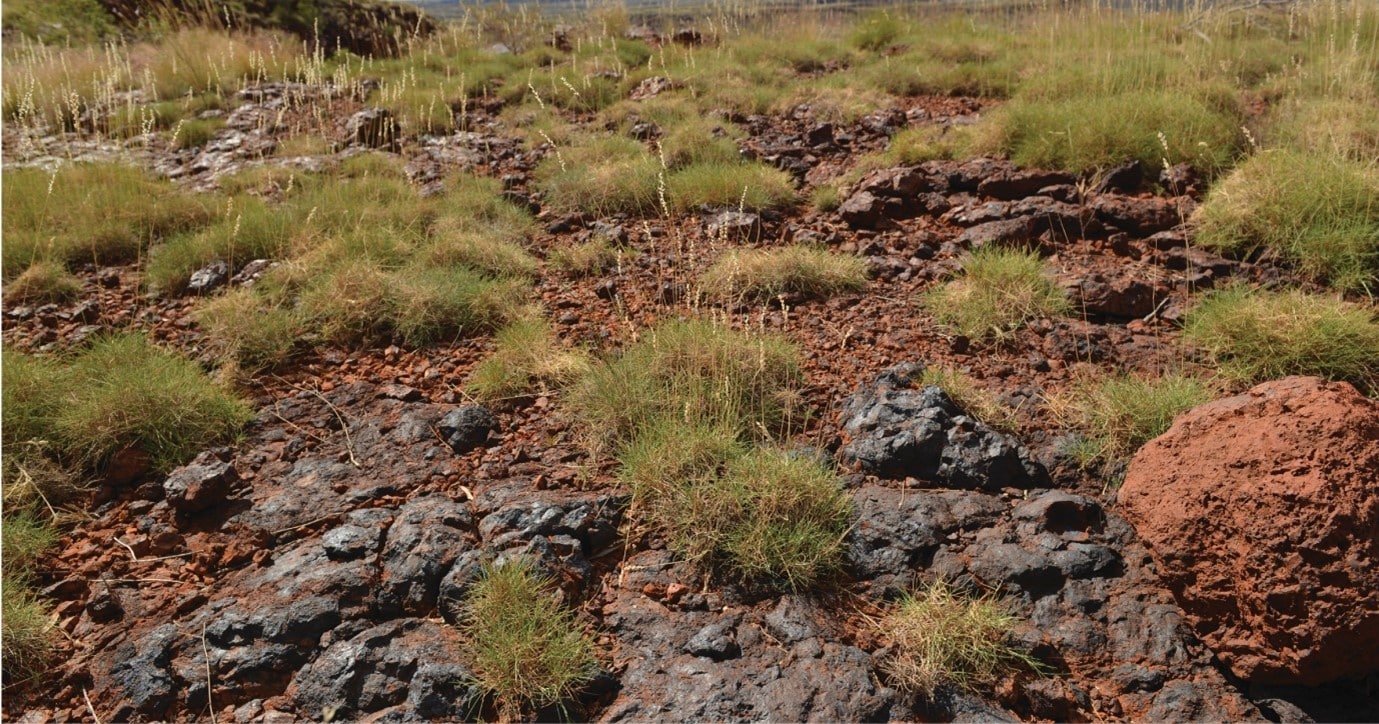

Captives, however, are more likely to be suitable for large commercial organisations, multi-national corporations, financial institutions, and growing middle-market companies. Businesses within the construction, mining and exploration, transportation, warehousing, wholesale distribution, and food and beverage industries are often well suited to captive insurance.

What kinds of risks can be covered?

A captive can cover any risk except for where it is legally prohibited from doing so.

Typically the types of risk that can be covered include:

- professional indemnity

- property damage

- all-risk property

- business interruption

- loss from natural disasters

- D&O

- cyber liability

- credit default

- employer’s liability

- workers’ compensation

- automotive liability

- general liability

- construction defects

- products liability

- product recall

- intellectual property

- environmental liability, and

- other insurance not available through the traditional insurance market.

What are the benefits?

Captive insurance provides a number of benefits to the parent company. It is often pursued when traditional insurance solutions are not available or do not provide the level of cover required.

The self-designed solution enables the business to better manage risks and insurance needs. Predominantly, captives are used by companies as a strategic risk management tool that enables them to gain greater control over their risk program, especially around policy terms and conditions. The company can gain greater financial flexibility, while increasing its protection.

Benefits of using the captive insurance model include:

- greater control over risk management

- potential cost savings in insurance premiums

- ability to tailor insurance cover to meet specific needs

- improved coverage

- reduced dependency on commercial markets

- creation of a vehicle (through the accumulation of premiums over time) to allow the spread of financial risk over multiple profit and loss periods, and

- benefits from the underwriting profits.

Explore your options

Captives cannot totally replace traditional insurance, but may be an option for larger corporates and mid-sized companies looking to protect against certain risks. Talk to your EBM Account Manager about traditional and alternative risk transfer options for your business.